Services

Credit, Keys, & Beyond Consulting Firm

From credit repair to real estate investment—your success is our mission.

Credit Building Strategies

Empowering you to take control of your credit score.

Our credit building services provide actionable plans to improve your financial profile and achieve your personal and professional goals.

Key Points:

- Tailored strategies to boost your credit score.

- Personalized consultations to identify and address credit issues.

- Guidance on managing credit utilization and debt effectively.

- Insights on maintaining long-term credit health.

One-on-One Financial Consultations

Your personalized roadmap to financial success.

Our private consultations are designed to address your unique financial challenges and goals.

Key Points:

- Individualized action plans to improve financial standing.

- Assistance in achieving credit and homeownership milestones.

- Flexible virtual appointments for your convenience.

Financial Wellness Planning

Your guide to a secure financial future.

We create detailed financial plans that help you balance current needs with long-term aspirations.

Key Points:

- Budget creation tailored to your lifestyle.

- Emergency fund planning for financial stability.

- Debt repayment strategies that work for you.

- Financial goal-setting for a brighter future.

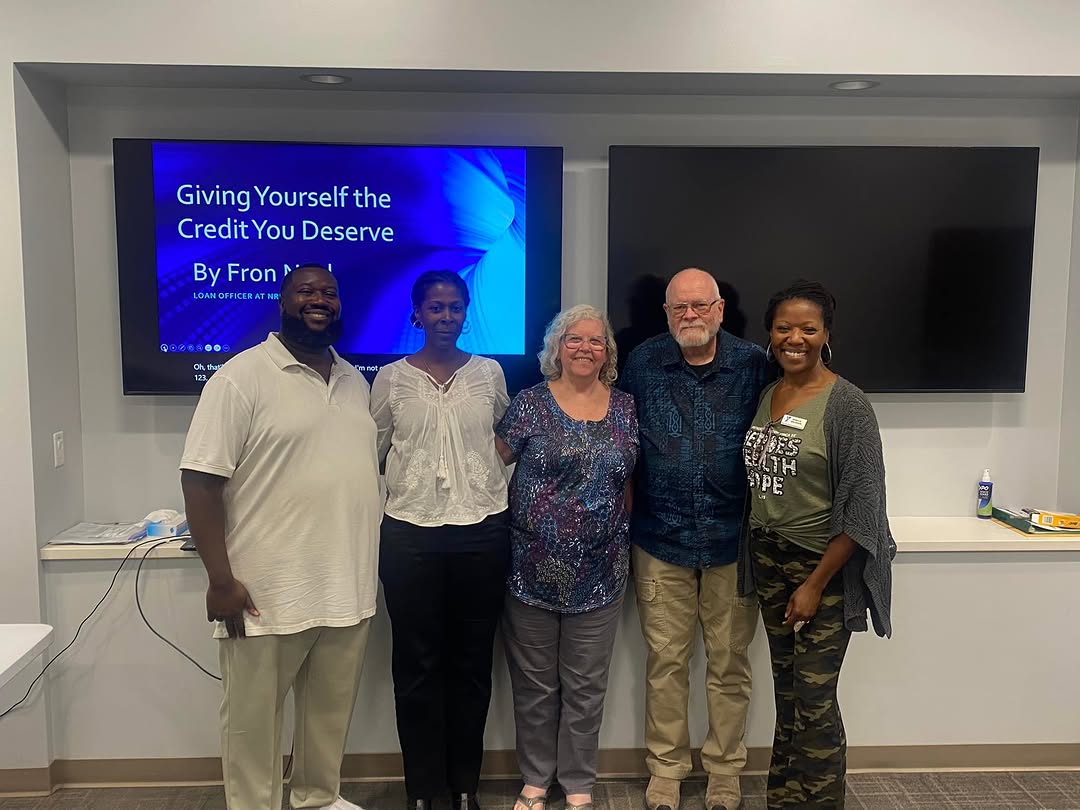

Workshops and Educational Seminars

Knowledge is power—empower yourself.

Our workshops equip you with the tools and knowledge to make informed financial decisions and achieve your goals.

Key Points:

- Actionable credit strategies tailored to your goals.

- First-time homebuyer steps and strategies.

- Home retention and budgeting skills.

- Available in-person or online via Zoom.

Mortgage Consulting Services

Expert advice for selecting the best financing options.

We simplify the complexities of mortgage selection, ensuring you get the best terms for your financial situation.

Key Points:

- Comparison of loan options and terms.

- Advice on securing competitive interest rates.

- Support in understanding mortgage documents.

- Insights on leveraging equity for future investments.

Real Estate Investment Guidance

Helping you invest with confidence.

We provide expert insights into real estate markets, ensuring you make informed investment decisions that align with your goals.

Key Points:

- Market analysis for potential investment opportunities.

- Guidance on financing and budgeting for real estate ventures.

- Strategies for long-term property management and growth.

First-Time Homebuyer Assistance

Making homeownership dreams a reality.

We simplify the homebuying process by providing expert advice and support, ensuring first-time buyers feel confident every step of the way.

Key Points:

- Assistance with mortgage pre-approvals.

- Education on loan options and financial planning.

- Support from property selection to closing.

- Resources to navigate state and federal programs.

Refinancing Guidance

Helping you unlock financial savings through refinancing.

We offer expert advice to help you secure better terms, reduce payments, or achieve other financial goals through refinancing.

Key Points:

- Lower interest rates and monthly payments.

- Explore cash-out refinancing options.

- Professional guidance on timing and refinancing strategies.

Educational Classes & Workshops

Empowering clients through education is at the heart of what we do. We offer in-person and online classes on essential financial topics:

- Credit Growth Fundamentals: Learn the dos and don’ts of improving your credit score.

- First-Time Homebuyer Steps: Gain clarity on homebuying essentials and processes.

- Home Retention Strategies: Discover techniques for budgeting and maintaining homeownership stability.

- In-Person Classes: For groups of 6 or more, lasting 2-2.5 hours.

- Zoom Classes: Interactive, condensed sessions with Q&A.

Home Retention Guidance

Maintaining homeownership requires strategic planning, and we’re here to support you.

- Develop financial strategies to avoid foreclosure.

- Plan for long-term success with sustainable budgeting.

- Receive insights into managing property-related expenses.

Down Payment Assistance Programs

Making homeownership more accessible.

We help clients explore and apply for down payment assistance programs, bridging the gap to make purchasing a home possible.

Key Points:

- Identification of applicable funding opportunities.

- Support in qualifying for state, federal, or local assistance programs.

- Step-by-step guidance through the application process.

Why Choose Our Services?

At Credit, Keys, & Beyond Consulting Firm, we deliver personalized solutions to improve your credit, secure your dream home, and achieve lasting financial success. With expert guidance, a client-first approach, and proven results, we’re here to help you unlock your financial potential!

Tailored Expertise for Every Stage

Whether you're building credit, buying your first home, or refinancing, we offer customized solutions designed to meet your unique financial needs.

Local Knowledge, National Impact

Helping clients across Greater Indianapolis and beyond.

Proven Success

A track record of satisfied homeowners and strengthened financial profiles.

Comprehensive Services

From credit repair to closing and beyond, we’ve got you covered.

Client-Centered Approach

We listen, educate, and guide every step of the way.